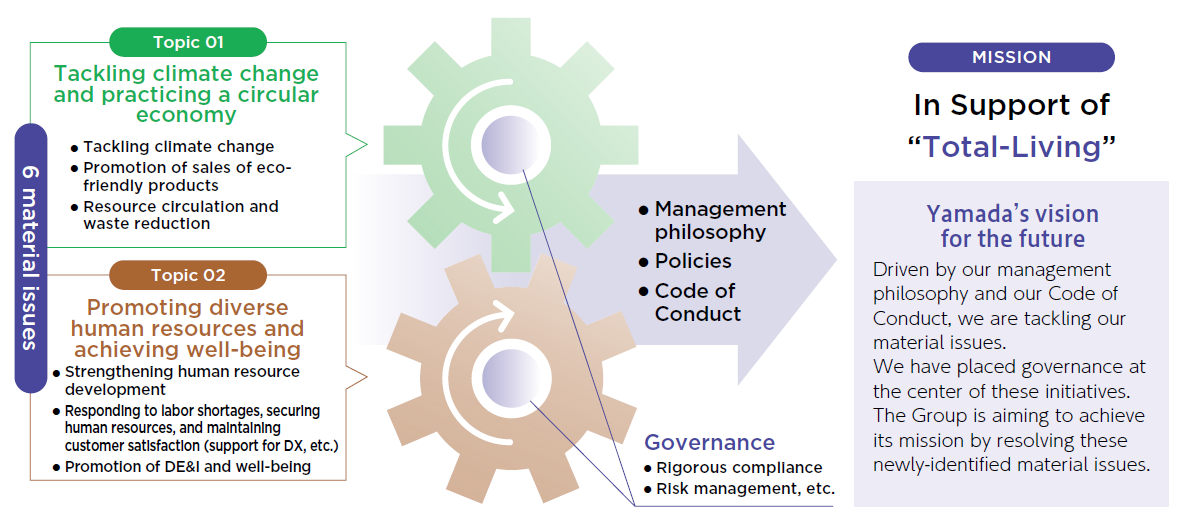

At YAMADA HOLDINGS Group, under our mission of "In Support of Total-Living," we aim to serve as a part of social infrastructure by continuously supporting our customers’ lives as a whole. To achieve this, we have identified our materiality and are proactively advancing initiatives to address them.

With a medium- to long-term perspective looking toward 2030, we have identified two key themes as material issues that must be addressed to achieve sustainable growth, based on evaluations from both our internal (company’s) and external (stakeholders’) viewpoints: (1) Tackling Climate Change and Practicing a Circular Society, and (2) Promoting Diverse Human Resources and Achieving Well-Being.

Through various initiatives, including addressing climate change, reducing energy consumption, promoting resource circulation, and minimizing waste across our Group, we are committed to reducing environmental impact and contributing to a sustainable future.

In addition, to ensure that each employee can lead a fulfilling life both physically and mentally, we are working to enhance well-being by promoting health, work-life balance, and advancing DE&I (Diversity, Equity & Inclusion) initiatives. Furthermore, by offering products and services that support physical and mental health, we aim to comprehensively support our customers’ lives.

Important decisions are made at the “ESG & Sustainability Promotion Committee,” which serves as the forum for deliberating on sustainability-related policies and initiatives, including materiality, as well as for reviewing the progress of related goals. The YAMADA HOLDINGS Group promotes initiatives addressing materiality across the group to reduce and avoid significant management risks and to expand business opportunities. Through these efforts, we aim to enhance corporate value and contribute to solving environmental and social issues.

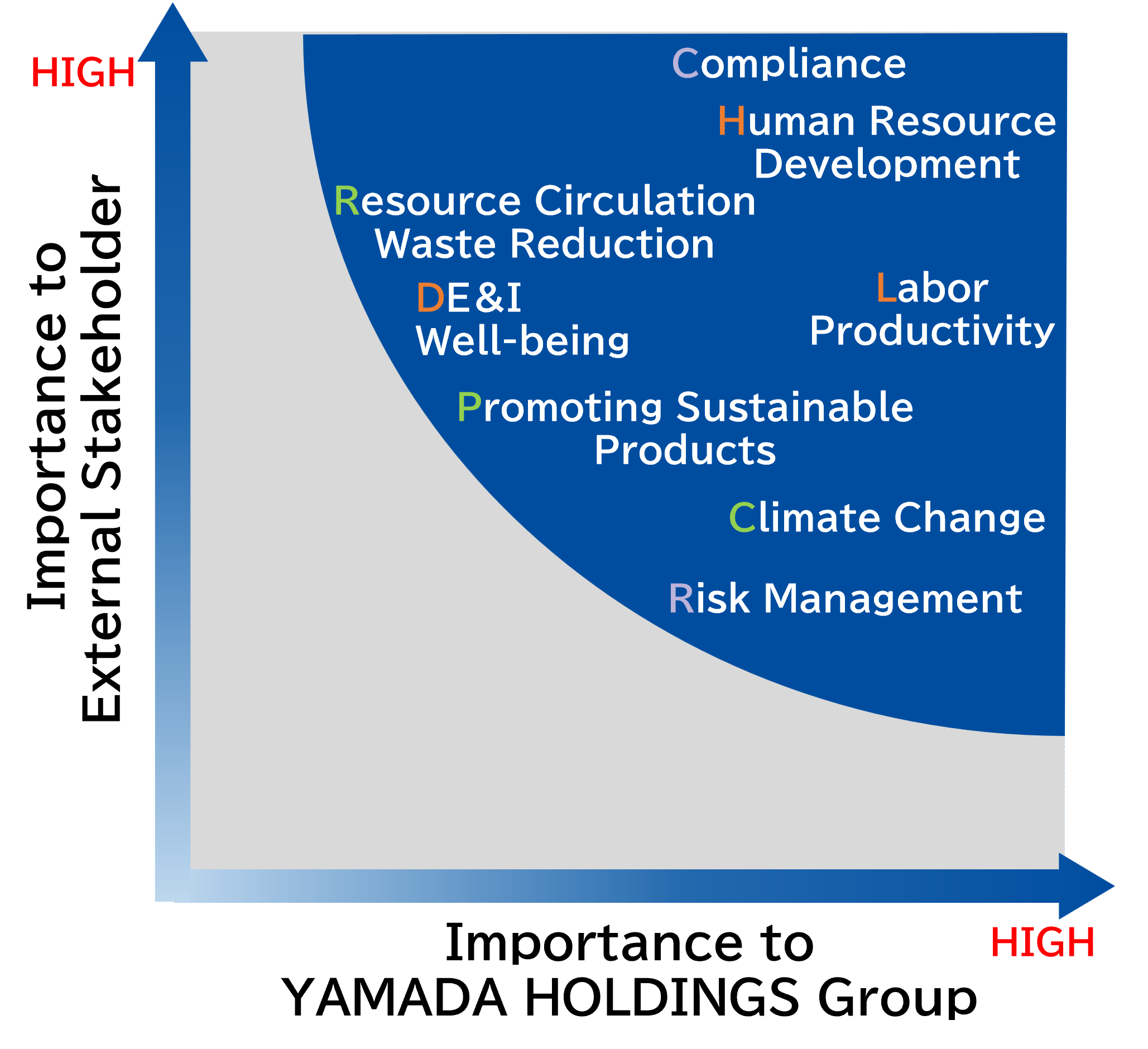

In 2019, the YAMADA HOLDINGS Group identified “Priorities Towards Achieving the SDGs.” However, as global attention to sustainability and ESG (Environmental, Social, and Governance) continues to grow, and as the external environment and business conditions surrounding our Group continue to change, we have reviewed and updated our materiality and related KPIs in 2025, following the process outlined below.

▲ Materiality Matrix

The YAMADA HOLDINGS Group is committed to addressing six materiality: ①"Tackling Climate Change" ②"Promoting Sustainable Products" ③"Resource Circulation and Waste Reduction" ④"Strengthening Human Resource Development" ⑤"Enhancing Workforce Stability and Customer Satisfaction through DX and Internal Improvements" ⑥"Advancing DE&I and well-being"

Our initiatives, goals, and KPIs related to this materiality are as follows.

| Material issues | Specific initiatives (KPI) | Target year | Target | FY2025 results |

|---|---|---|---|---|

| Tackling climate change | Reduction of Scope 1 and 2 CO2 emissions | FY2031 (compared to FY2021) |

Down 42% | Down 13.6% |

| Reduction of CO2 emissions from electricity use per floor area | Down 53% | Down 13.2% | ||

| Percentage of renewable energy out of total power consumption | FY2031 | 38% | 3.92% | |

| Promotion of sales of eco-friendly products | Percentage of home appliances (TVs, refrigerators, and air conditioners) sold that meet the 100% energy-saving standard under the energy-efficiency labeling system | 60% | 44.8% | |

| Sales of YAMADA GREEN-certified products | Every year | Increase on previous fiscal year | Sales ¥10,587 million Up 175.4% YoY |

|

| Sales of disaster preparedness products (emergency supplies and portable power supplies, etc.) |

Sales ¥2,542 million Up 27.8% YoY |

|||

| ZEH supply rate | FY2031 | 50% | 45% | |

| Solar panels shipped | 50,000 panels | 32,941 panels | ||

| Resource circulation and waste reduction | Reuse of 4 household appliances (TVs, refrigerators, washing machines, and air conditioners) |

FY2030 | 300,000 units | 156,899 units |

| Reuse & recycle of computers | FY2026 | 344,300 units | 335,482 units | |

| Number of small home appliances recycled | FY2030 | 1,000,000 units | 843,128 units | |

| Strengthening human resource development | Average hours of training per employee | FY2031 | 30 hours or more/year | 21 hours/year |

| Responding to labor shortages, securing human resources, and maintaining customer satisfaction (support for DX, etc.) | Sales per person | FY2030 | ¥71 million/year | ¥54.72 million/year |

| Sales from e-commerce and TV shopping | ¥190 billion | ¥101.8 billion | ||

| Full-time employee turnover rate | FY2031 | 4.5% | 4.4% | |

| Promotion of DE&I and well-being | Controls on long working hours | Every year | Percentage of companies that reduce overtime hours: YoY increase | Percentage of companies achieving YoY control of overtime hours: 53.8% Down 16.6 points YoY |

| Percentage of paid leave taken | FY2031 | 80% | 58.1% | |

| Ratio of female managers | 10% or more | 4.1% | ||

| Percentage of health checkups taken | 100% | 95.6% | ||

| Percentage of stress tests taken | 100% | 96.5% | ||

| Engagement survey | Overall rating of A | Overall rating of B | ||

| Frequency rate of accidents that require time off work | 0.50 or less | 1.14 | ||

| Percentage of female and male employees taking childcare leave | FY2029 | Female: Maintain 100% Male: 80% or more |

Female: 100% Male: 36.2% |