YAMADA HOLDINGS Group is striving to reduce its impact on the environment by monitoring and managing the amount of energy use in business activities, as well as CO2 and waste emissions. We handle a wide variety of home appliances, housing equipment, and furniture and interior goods that support customers’ lifestyle based on the “Total-Living” concept. These products are manufactured and processed not only in Japan but also in other parts of the world, using various resources from each region. For this reason, we believe that tackling climate change and preserving the natural environment are important themes for the sustainable growth of the Group.

In preparation for disclosures based on the Task Force on Climate-related Financial Disclosures (TCFD) and the Task Force on Nature-related Financial Disclosures (TNFD), the Group is examining the current state of the whole Group, developing a governance system, and reviewing strategies, risk management, metrics, and targets. Going forward, we will continue to appropriately manage the risks related to climate change and environmental issues, including natural environments and resource circulation, while viewing various changes toward the conservation of natural environments and a decarbonized society as business opportunities that will lead to sustainable growth, and we are actively advancing our environmental initiatives.

Regarding our response to the TNFD, following our support for the recommendations, we have joined the "TNFD Forum" and registered as a "TNFD Adopter." We will proactively incorporate the latest domestic and international insights on natural capital and strive to enhance the quality of our information disclosure.

Our Group is promoting sustainability activities based on appreciation and trust with respect to its stakeholders. For our Group to achieve sustainable corporate value enhancement, consideration for governance is essential.

At our company, the Board of Directors discusses important management and business strategies, makes policy decisions, and supervises the ESG & Sustainability Promotion Committee. The ESG & Sustainability Promotion Committee makes decisions on important matters, and subcommittees thereunder discuss the details of individual activities and confirm the progress of activities and targets. In addition to the climate change risks and opportunities identified from scenario analysis, important issues such as risks and opportunities in the natural environment and resource circulation are examined by the committee, which regularly reports to the Board of Directors on the status of addressing these risks, so that the Board of Directors can fully exercise its supervisory function.

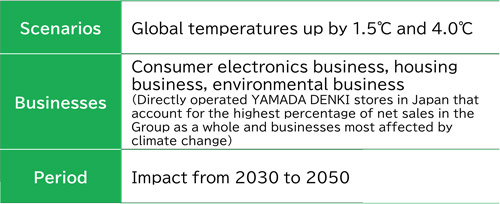

Based on the TCFD recommendations, the Group has established the target businesses, timelines, and scenarios to analyze and assess the climate change risks and opportunities.

This scenario sees the tightening of regulations and policies for decarbonization, with measures against climate change progressing and a temperature rise from pre-industrial levels at around 1.5 to 2.0℃. As customers’ preferences for products and services change and companies are more strongly required to tackle climate change, it is likely that transition risks, including fewer customers and greater reputational risk, will increase if the companies fail to do so. Conversely, it is assumed that the physical risks would be relatively low compared to the 4.0℃ scenario, with, for example, more extreme and prevalent disasters caused by climate change being suppressed to some extent. (Reference: The International Energy Agency’s Net Zero Emissions by 2050 Scenario)

A scenario in which sufficient measures against climate change are not taken and the temperature rises around 4.0℃ from pre-industrial levels. It is assumed that physical risks would increase, with, for example, more extreme natural disasters, rising sea levels, and an increase in abnormal weather events. As a result, it is thought that climate change-resilient products and services in terms of good business continuity plan (BCP) will become more competitive. Conversely, it is assumed that transition risks would be low, with, for example, the government’s lack of tighter regulations. (Reference: The Intergovernmental Panel on Climate Change’s RCP8.5 Scenario)

Using the Company’s database on hazard maps, we have identified 36 stores, out of our 1,057 stores and offices in the Consumer Electronics Segment nationwide, that require priority attention for flood risk. (The percentage of net sales of the priority locations identified is 3%)

Based on the TNFD recommendations, the Group has analyzed and assessed the dependence on and impact of natural capital in its business activities. We have adopted the LEAP approach suggested by the TNFD recommendations and adjusted business activities in our direct operations and value chain (upstream and downstream) in the Consumer Electronics Segment (Japan only).

We have evaluated our dependencies and impact on natural capital using ENCORE, which is one of the tools suggested by the TNFD, for the scope of our own direct operations and for our major business partners.

From the results of the evaluation of our dependencies and impact on natural capital in our business activities, we identified water-related risks as one of the key issues in the scope of our Consumer Electronics Segment operations. We therefore used Aqueduct tools, which are provided by the World Resources Institute (WRI), to assess water stress in the scope of our Consumer Electronics Segment operations, and we identified the stores that require priority attention based on the results. As a result, we verified the water stress levels of 70 stores, prioritized based on net sales by store and sales floor areas, and, while there were none with levels of high or above, we identified 34 stores requiring priority attention due to medium-high levels of water stress.

Based on an analysis of the dependencies and impact on natural capital that are related to our business, we also assessed the natural capital-related risks and opportunities and identified the ones that are important. Going forward, we will work even harder to intensify initiatives that are based on the TNFD recommendations aimed at managing risks and creating opportunities related to natural capital.

Transition Risks

| Category | Subcategory | Items | Time scope | Effect on business | Impact level | Response | Business impact |

|---|---|---|---|---|---|---|---|

| Policy and regulation | Climate change and natural capital | Strengthening regulations in the supply chain | Short- to medium-term |

Increase in procurement costs due to tighter regulations in the supply chain |

Medium |

Actively supporting suppliers’ natural environment protection activities, responding to the risk of rising procurement costs

A questionnaire is conducted once a year targeting major business partners, and if any companies are deemed to be high risk, hearings or requests for improvement are carried out.

|

- |

| Natural capital | Waste and recycle regulations | Short- to medium-term |

Increased costs in waste treatment and recycling processes

|

Medium |

Promotion of the reduction of industrial waste and the proper recycling of waste

Reduction regulatory compliance costs by moving waste treatment and recycling processes in-house

At the waste-to-energy plant, heat from incinerated waste will be used to generate electrical energy (scheduled to start operations in March 2027).

|

- | |

| Climate change | Carbon tax/ Carbon pricing | Short- to medium-term |

Increased electricity consumption costs throughout the company due to carbon pricing (carbon tax, etc.)

|

High |

Managing power-on/off for lighting, air-conditioning, and exhibits at YAMADA DENKI stores

Switching to energy-saving equipment at YAMADA DENKI stores

Promoting the installation of self-consumption solar panels at YAMADA DENKI stores

|

Estimated carbon tax payable in 2030: ¥3.6 bn |

|

|

Need for developing price competitiveness including carbon pricing, low-carbon materials and construction technology

|

High |

Addressing the risk of rising procurement costs by supporting decarbonization activities at suppliers and streamlining manufacturing lines and manufacturing technologies

Carrying out more joint procurement with Group companies

Promoting development of low-carbon products by implementing an eco-friendly design assessment during product design

|

Minimum -¥15.3 bn Maximum -¥65.5 bn |

||||

| Climate change | Energy-saving regulations | Short-term | Tightened regulations such as energy-saving standards |

High |

Providing opportunities to learn about relevant laws and regulations by supporting the acquisition of external qualifications such as Home Appliance Advisor and Smart Master

Encouraging all employees to understand and acquire knowledge about energy-saving through the in-house SDGs Meister System qualification so they can provide explanations to consumers and encourage them to switch to more energy-efficient products that will contribute to a decarbonized/low-carbon society

Promoting widespread use of energy-saving home appliances through active participation in local government subsidies to replace products for energy-saving home appliances

Responding to the risk of rising procurement costs by further streamlining procurement and delivery

Actively supporting suppliers’ decarbonization activities, responding to the risk of rising procurement costs

|

One-year increase in unit sales -9% Amount -¥35.4 bn |

|

Increased store/office operating costs due to rising energy costs |

High |

Carefully managing power-on/off for lighting, air-conditioning, and exhibits at YAMADA DENKI stores

Switching to energy-saving equipment at YAMADA DENKI stores

|

Average closing cost per store: ¥15 m |

||||

| Market | Climate change | Changes in customer behavior | Short-term |

Longer replacement cycles for durable consumer goods (mainly home appliances and furniture), leading to drop in net sales

|

High |

Encouraging all employees to understand and acquire knowledge about energy-saving through the in-house SDGs Meister System qualification so they can provide explanations to consumers and encourage them to switch to more energy-efficient products that will contribute to a decarbonized/low-carbon society

Promoting widespread use of energy-saving home appliances through active participation in local government subsidies to replace products for energy-saving home appliances

Responding to the risk of rising procurement costs by further streamlining procurement and delivery

Promoting widespread use of products that contribute to building a low-carbon society

|

One-year increase in unit sales -9% Amount -¥35.4 bn |

| Reputation | Climate change and natural capital | Decrease in sales due to inadequate response to climate change and nature-positive initiatives | Short- to medium-term |

Recognized by consumers as not eco-friendly enough, resulting in drop in net sales

|

Medium |

Appropriate communication with consumers

Paying close attention to consumers’ environmental awareness

Strengthening responsiveness by expanding the segments subject to TNFD compliance

|

- |

| Climate change and natural capital | Fewer customers visiting stores due to declining quality and safety of products | Short- to medium-term |

Decrease in customers visiting stores due to declining quality and safety of the products we handle

|

High |

Establishing a monitoring system for product manufacturing

Mainly selects ISO 9001-certified companies as manufacturers for SPA products

|

- | |

| Climate change and natural capital | Stronger demands for disclosure | Short- to medium-term |

Disclosure of initiatives for climate change and nature-related issues rated insufficient by stakeholders, resulting in a fall in stock prices

|

Medium |

Appropriate disclosure in line with TCFD and TNFD frameworks

|

- |

Physical Risks

| Category | Subcategory | Items | Time scope | Effect on business | Impact level | Response | Business impact |

|---|---|---|---|---|---|---|---|

| Acute | Climate change and natural capital | Business suspension due to climate change | Short-term |

Stores affected by extreme weather and opportunities lost due to closures

Store closures and fewer customers visiting stores due to natural disasters (torrential rain, bigger typhoons, etc.) caused by climate change

|

High |

Sharing knowledge about natural disaster responses

Stockpiling disaster supplies in stores

Regular review and revision of the business continuity plan (BCP) management rules in preparation for large-scale disasters

Implementation of fire drills and manual-based training at the headquarters and each store

|

- |

| Climate change and natural capital | Damage to our locations due to extreme weather | Short-term |

Increased capital investment for recovery from damage due to typhoons, torrential rain, etc.

|

High |

Sharing knowledge about natural disaster responses

Appropriate insurance coverage

|

- | |

| Climate change and natural capital | More extreme weather | Short-term |

Damage or suspension of business due to natural disasters at stores, sales offices, or plants, and disrupted distribution and transportation networks, resulting in drop in net sales

|

High |

Considering location and layout of new stores and show homes on the basis of possible flood damage

Strengthening measures against water risks at stores and show homes based on results of water risk assessment

Created recovery manuals in the event that stores/sales offices/plants stop functioning

Formulating BCP for procurement and distribution systems

Use of IT in operations and business negotiations

Increasing product inventories

|

1 day suspension of business: -¥0.9 bn |

|

| Chronic | Climate change and natural capital | Changes in precipitation/ weather patterns | Short-term | Damage or suspension of business due to heavy rain at stores, sales offices, or plants, and disrupted distribution and transportation networks, resulting in drop in net sales |

High |

Considering location and layout of new stores and show homes on the basis of possible flood damage

Strengthening measures against water risks at stores and show homes based on results of water risk assessment

To respond to more extreme natural disasters, assessing the degree of danger at locations using hazard maps and other means, formulating BCP in readiness for disasters

|

1 day suspension of business: -¥0.9 bn |

Changes in vegetation and timber procurement areas lead to increased timber procurement costs |

High |

Securing timber suppliers in readiness for forest protection

|

Maximum +¥4.7 bn |

||||

| Climate change | Rise in average temperatures | Long-term |

Customers less likely to go out, refraining from purchasing in store

|

High |

Strengthening sales channels with e-commerce

Use of IT for online consultations and business negotiations

|

Extreme heat for 20 days: -¥0.4 bn |

Opportunities

| Category | Subcategory | Items | Time scope | Effect on business | Impact level | Response | Business impact |

|---|---|---|---|---|---|---|---|

| Resource efficiency | Climate change | Cost reduction through the introduction of renewable energy | Short- to medium-term |

Decrease in energy costs by actively implementing various climate change-related incentives to introduce renewable-energy and energy-saving equipment

|

High |

Introduction of solar power systems utilizing store rooftops (contributing to the reduction of environmental impact through the sale of electricity)

Introduction of self-consumption solar power systems utilizing store rooftops (reducing electricity usage)

|

Electricity sales results: Approx. 50,000 MWh Annual fees for electricity usage: -¥0.15 bn |

| Natural capital | Efficient use of water resources | Short- to medium-term |

Reduced water costs by introducing water-saving equipment

|

Medium |

Introduction of water-saving equipment in stores

|

- | |

| Natural capital | Effective use of reuse and recycling | Short- to medium-term |

Increased net sales due to the recycling of customers’ home appliances

|

High |

Further promotion of the building of a circular economy by expanding reuse and recycling plants

|

Sales volume: +300,000 units Net sales: +¥5.5 bn |

|

| Products and services | Climate change | Rollout of low-carbon and decarbonized products and services | Short-term | Increased net sales due to promotion of energy-saving home appliances |

High |

Sale of home appliances (TVs, refrigerators, and air conditioners) that meet the 100% energy-saving standard under the energy-efficiency labeling system

Providing more economic support through financial services such as flat-rate systems

|

Increased customer traffic and sales |

| Climate change and natural capital | Changes in consumer preferences | Short-term | Increased sales due to increased demand for eco-friendly products and services |

High |

Strengthening the handling of eco-friendly products and services in all business segments

Sales of YAMADA GREEN-certified products aimed at realizing a circular economy and building a sustainable society

|

Net sales: +¥10.5 bn |

|

| Short-term | Increased sales due to changing consumer demand caused by rising average temperatures |

High |

Developing Sales Engineers and promoting the acquisition of external qualifications

Enhancing information-gathering activities pertaining to consumer needs

|

- | |||

| Climate change and natural capital | Increased demand for natural disaster preparedness products | Short-term | Increased sales due to growing demand for natural disaster preparedness products (storage batteries, flashlights, lanterns, etc.) |

Medium | Expanding handling of disaster preparedness products |

Net sales: +¥2.5 bn |

|

| Climate change and natural capital | Responding to more severe viruses and biohazards | Short- to medium-term |

Increased demand for reducing the risk of new viral infections and exterminating harmful organisms |

Medium |

Building systems that enable prompt responses

Strengthening information-gathering and the promotion of related products

|

- | |

| Reputation | Climate change and natural capital | Ensuring business continuity during disasters | Short-term | Improved reputation by establishing resilient business that is prepared for natural disasters |

Medium |

Regular review and revision of the BCP management rules in preparation for large-scale disasters

Investigation of disaster risks when opening new locations

Implementation of fire drills and manual-based training at the headquarters and each store

|

- |

*Target: Consumer Electronics Segment (stores in Japan)

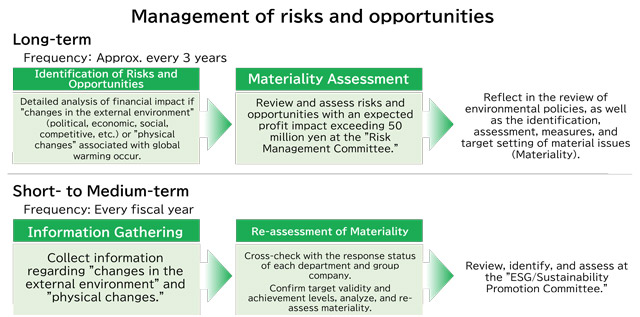

We consider risks related to climate change, environmental issues including natural environments and resource circulation, as one of the most significant risks impacting our Group’s business and integrate them into our overall risk management process. For long-term risk and opportunity assessments, approximately every three years, the Sustainability Promotion Department conducts a detailed analysis of external environmental changes such as political, economic, social, and competitive changes due to the transition to a decarbonized society and physical changes due to the progression of global warming. We analyze the probability that various changes may occur and the financial impact if these risks materialize to identify risks and opportunities. For risks and opportunities with a financial impact on revenue exceeding 50 million yen, they are reviewed by the Risk Management Committee and evaluated as significant risks and opportunities for the Group. Based on the risks and opportunities assessed by said committee, we revise our Environmental Policy and reflect these in identifying and evaluating key issues, major initiatives, and goal setting.

Meanwhile, for short- to medium-term risk and opportunity identification and evaluation, we gather information on external environmental changes and physical changes throughout the fiscal year. In light of the response status of each department and Group company, we analyze the validity and achievement of targets and reevaluate significance. If significant revisions arise, they are discussed, identified, and evaluated at the ESG & Sustainability Promotion Committee. The discussions held by the ESG & Sustainability Promotion Committee are reported to the Board of Directors.

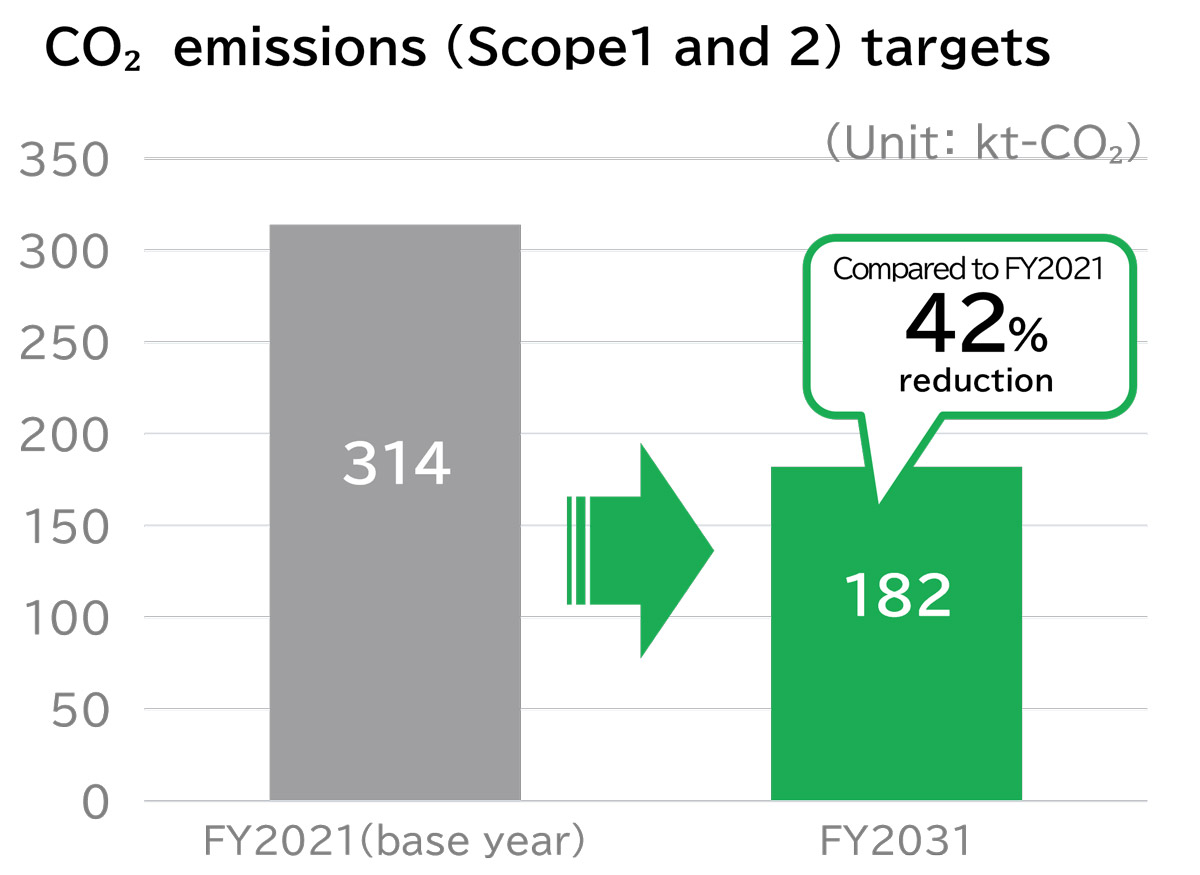

The Group has set a goal of reducing CO2 emissions in Scope 1 and 2 by 42% by FY2031, compared to FY2021. We are focusing on reducing electricity usage at YAMADA DENKI stores, which account for the majority of our Scope 1 and 2 emissions, and we are promoting further energy conservation at our stores. In addition, we are setting targets for each Scope 3 item and working to reduce those emissions as well.

We have obtained limited assurance (based on International Standard on Assurance Engagements 3000 and 3410) for consolidated Group CO2 emissions in Japan in FY2025 for Scope 1 and 2 (market-based) and Scope 3 (the total of categories 1, 2, 3, 4, 5, 6, 7, 11, 12, and 14).