YAMADA HOLDINGS works to clarify management responsibilities, make quick management decisions, maintain and improve corporate value and stakeholder value while enhancing management transparency and conducting fair corporate activities.

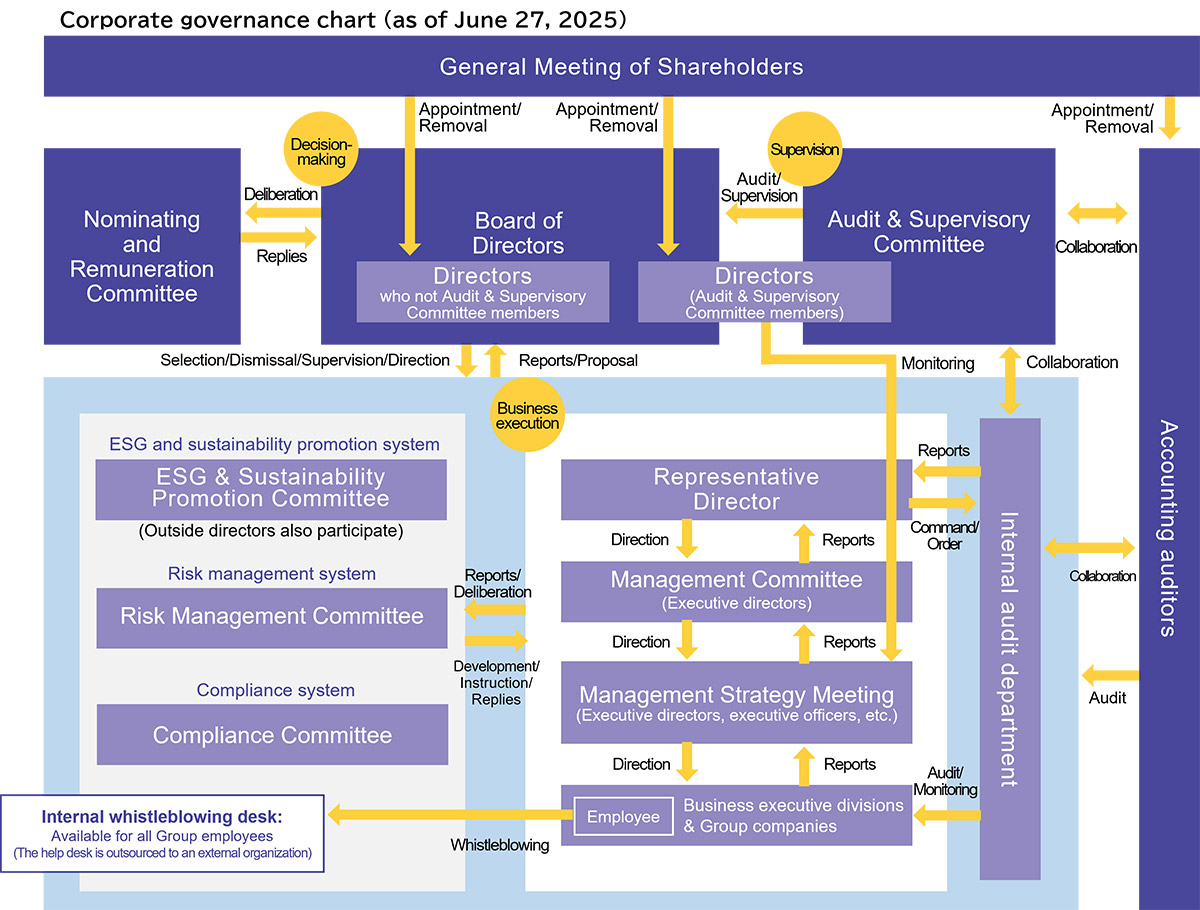

| Board of Directors | Comprised of 12 directors. The chairperson is the representative director. Regular board meetings are held once a month, and extraordinary board meetings are held when necessary. Discusses and decides important management matters and oversees the progress of business performance. |

|---|---|

| Audit & Supervisory Committee | Consists of five directors who are Audit & Supervisory committee member. Held once a month. Directors attend important meetings such as the Management Strategy Meeting and commit the business execution divisions in accordance with the audit standards, etc. established by the Audit & Supervisory Committee. Conducts audits, monitoring, and other activities in the execution of directors’ duties. |

| Management Committee | Held twice a month. Decides a broad range of management policies and strategies, based on discussions and evaluations of reports and proposals on management policies, strategies, challenges, and business execution. |

| Nominating and Remuneration Committee | Eight directors, the majority of whom (five) are independent outside directors, ensure objectivity and transparency in the process of determining executive personnel and remuneration. |

Our company transitioned from a company with an Audit & Supervisory Board to a company with an Audit & Supervisory Committee on June 27, 2024. Under a governance structure consisting of the Board of Directors and Audit & Supervisory Committee, we have clearly separated the management functions of decision-making, supervision, and business execution. In order to be able to respond quickly to changes in the business environment surrounding the Group, we have introduced a business execution system consisting of executive directors and executive officers, and have put in place a system that clarifies management responsibilities. In addition, to ensure the objectivity and transparency in matters carried out by the Board of Directors in relation to the determining of executive personnel and the processes by which remuneration is decided, a Nominating and Remuneration Committee has been established as an optional deliberation body.

Corporate Governance System Overview (as of June 27, 2025)| Main Items | Description |

| Type of organization | Company with an Audit & Supervisory Committee |

|---|---|

| Chairperson of the Board of Directors | Representative Director |

| Number of directors | 12 (of which 2 female) |

| Number of outside directors | 5 (all independent) |

| Number of directors who are not Audit & Supervisory Committee members | 7 (of which 2 female) |

| Number of outside directors | 2 (both independent) |

| Number of directors who are Audit & Supervisory Committee members | 5 |

| Number of outside directors | 3 (all independent) |

| Number of executive officers | 14 |

| Term of office of directors who are not Audit & Supervisory Committee members | 1 years |

| Term of office of directors who are Audit & Supervisory Committee members | 2 years |

The Board of Directors consists of 12 directors in total (with five outside directors accounting for 41.7% of the total), including five directors who are Audit & Supervisory Committee members and seven directors who are not, and is chaired by the Representative Director. Regular Board of Directors meetings are held once a month in principle, with extraordinary meetings also held as necessary. All important matters are submitted to the Board of Directors, and progress in business performance is also discussed, with measures being taken promptly.

Main Items Discussed at the Board of Directors(FY2025)| Matters Discussed | ●Matters related to the General Meeting of Shareholders |

|---|---|

| ●Matters related to stock and corporate restructuring | |

| ●Approval and resolution of financial statements, reports and dividends | |

| ●Matters related to treatment and appointment of directors | |

| ●Approval of basic management policies | |

| ●Approval of business plans, budgets and expenditures | |

| ●Asset management | |

| ●Procurement and management of funds | |

| ●Sustainability-related considerations | |

| ●Matters related to execution of duties | |

| ●Approval of revision and enactment of regulations |

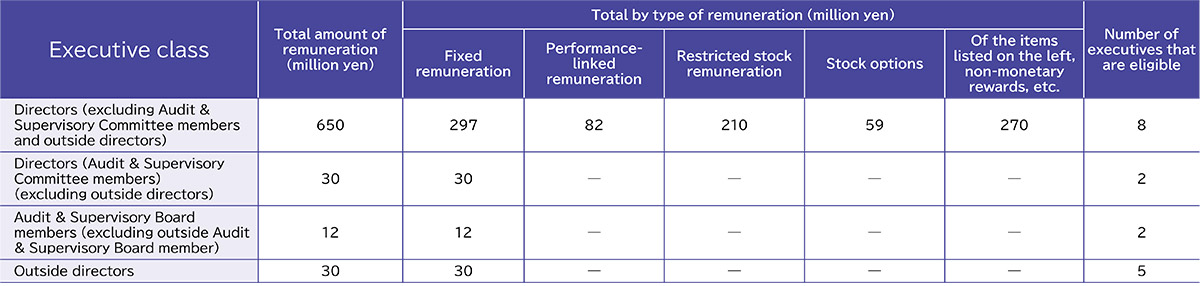

The Nomination and Remuneration Committee is composed of eight directors (including five outside directors, accounting for 62.5%) and is chaired by the Representative Director, ensuring objectivity and transparency in the process of determining executive appointments and remuneration. Remuneration for the Company’s directors (excluding directors who are Audit & Supervisory Committee members and outside directors) is determined within the total amount of remuneration approved at the General Meeting of Shareholders in accordance with the regulations, taking into consideration factors such as the degree of contribution, financial situation, and economic climate. A draft proposal is submitted to the Nomination and Remuneration Committee, it is then deliberated upon and reported to the Board of Directors, at which time a final decision is reached based on the resolution of the Board.

The Audit & Supervisory Committee consists of five directors who are Audit & Supervisory Committee members (including three outside directors who are also Audit & Supervisory Committee members; the ratio of outside directors is 60%) and meets once a month in principle. The directors audit and monitor the execution of duties by directors in accordance with the audit standards established by the Audit & Supervisory Committee, by attending not only Board of Directors meetings but also important meetings such as the Management Strategy Meeting, and various committees and subcommittees hosted by business execution divisions, and by investigating the status of assets, etc.

To achieve medium- to long-term growth, we are working to diversify our Board of Directors in order to adapt to ever-changing market needs and improve the quality of management decisions. To achieve this, we will strive to meet our goal of increasing the ratio of female directors to 30% or more by 2030.

Our company conducts surveys of directors to analyze and evaluate the effectiveness of the Board of Directors. In FY2025, the Board of Directors was evaluated from a new perspective following the transition to a company with an Audit & Supervisory Committee and the reelection of officers. As a result, the score was lower than the previous year, but the overall evaluation remained high. The effectiveness of our Board of Directors was assessed as being ensured, as an environment in which free and open discussions are maintained, including the chairperson’s management of proceedings in which each and every one of the directors are offered a chance to voice their opinions.

We will continue to improve the effectiveness of the Board of Directors by comparing it with the past and checking the status of improvements.

| Assessment Method | The Board secretariat determines the items to be assessed, and conducts a questionnaire survey directed at all 12 directors (seven internal directors and five outside directors) between January and March. The responses received from all directors were then analyzed and evaluated. |

|---|---|

| Assessment Item | |

| ●Role/function | |

| ●Size/structure | |

| ●Operation | |

| ●Internal control/auditing body | |

| ●Relationship with outside directors | |

| ●Relationship with shareholders and investors | |

| Overview of Assessment Results and Future Actions | The overall evaluation remained high (3.25 out of a maximum of 4). However, we recognized the need to further strengthen our governance system and expand opportunities to enhance insight into the business, and have therefore set out the priority tasks and policies that the Board of Directors should take on in the future, as shown in “Priority tasks and policy” below. |

| Priority Issues 1 Strengthening the governance system Policy In order to strengthening governance and risk management across the Group, we have established an appropriate management framework that includes identifying issues and potential risks in each committee and sharing information. |

|

| Priority Issues 2 Appropriate provision of training opportunities [ongoing issue] Policy To further enhance the roles expected of officers, we will create an environment in which they can deepen their understanding of the overall management by planning opportunities for dialogue and information sharing between outside directors and Audit & Supervisory Committee members and onsite inspections. |

|

| Priority Issues 3 Development of support systems [ongoing issue] Policy The content of materials presented to the Board of Directors will be improved and enhanced, and these will be shared in advance at an early stage, in order to enhance operations and enable more constructive discussions at the Board of Directors meetings. |

The remuneration of directors (excluding directors who are Audit & Supervisory Committee members and outside directors; hereinafter referred to as “Eligible Directors”) is determined within the total amount of remuneration approved at the General Meeting of Shareholders in accordance with the regulations, taking into consideration factors such as the degree of contribution, financial situation, and economic climate. A draft proposal is submitted to the Nomination and Remuneration Committee, it is then deliberated upon and reported to the Board of Directors, at which time a final decision is reached based on the resolution of the Board.

The remuneration for Eligible Directors consists of basic remuneration and bonuses as short-term incentives, medium-term restricted stock remuneration as a medium-term incentive, and long-term restricted stock remuneration as a long-term incentive.

Basic remuneration will be determined after comprehensively taking into consideration position, job duties, responsibilities, company performance, etc. As for bonuses, no specific conditions for achievement have been set, but the allocation amount will be determined after comprehensively taking into consideration company success and performance appraisals of fulfilling responsibilities, etc. Remuneration for directors that are Audit & Supervisory Committee members and outside directors is fixed in order to maintain proper and effective management supervision.

Currently, we are also discussing and considering linking ESG performance to performance-linked remuneration.

YAMADA HOLDINGS operates an effective governance system by continuously strengthening its compliance, information management and risk management based on the Company’s Internal Control System Basic Policy. The Risk Management Committee and Compliance Committee also fully share important matters to members of each department and each operating company by way of the Compliance Subcommittee, thereby making every effort to strengthen the management system to improve the effectiveness of internal control.

Each year, the YAMADA HOLDINGS Group holds a meeting at the YAMADA HOLDINGS headquarters with the participation of executives, representatives from every Group company, and employees to present its management policy. Representative directors from YAMADA HOLDINGS present policy for the following fiscal year while each segment gives a review on their respective annual action plans, reports on progress, and presents future goals.

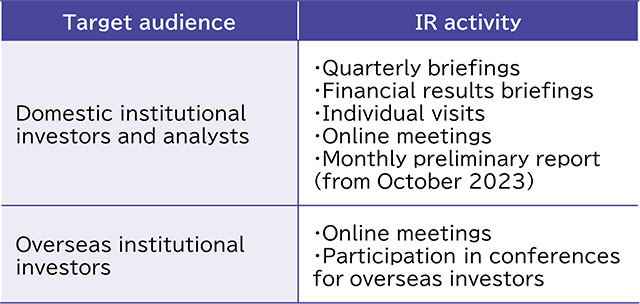

YAMADA HOLDINGS holds financial results briefings for analysts and institutional investors. At the briefing sessions, senior management directly explain YAMADA HOLDINGS’ management philosophy and policies, current performance, and future business strategies to give investors an opportunity to gain a deeper understanding of the Group.